Providing we have our health, the expectation for many anglers and hunters is that we’ll have more time to feed our outdoor passions in retirement. Our challenge will be affording to hunt and fish as much as we hope to, while still meeting our financial obligations on the home front. There are simple ways you can stretch a buck in retirement and find the extra dollars to make your hunting and fishing trips a frequent reality. Here are some of them.

If you are retired and working with an accredited financial professional, you should already be aware that Canada Revenue Agency (CRA) allows you to split qualified retirement income if you have a spouse. You and your spouse are allowed to have up to 50% of eligible income transferred to the spouse with the lower income. This often keeps thousands of dollars in the family rather than being sent to the government. Eligible income is defined as “income that is eligible for the pension income tax credit.”

Under age 65: With few exceptions, only income received directly from a Registered Pension Plan (RPP) qualifies for pension income splitting.

65 and older: Generally, income from Registered Retirement Income Funds (RRIFs), Life Income Funds (LIFs), annuities purchased with Registered Retirement Savings Plan (RRSP) money, and non-registered annuities are eligible for income splitting.

Canada Pension Plan (CPP): must be 65 and split/allocated at the government level, not via your tax return.

Spousal RRSPs: Three years after the last deposit, income splitting allowed at any age and is not limited to the 50% rule. RRSP withdrawals and Old Age Security (OAS) do not qualify.

What you may not be told, is that income from nonregistered investments generally do not qualify for pension income splitting and the pension tax credit. However, there is an exception...income received from a Guaranteed Interest Account

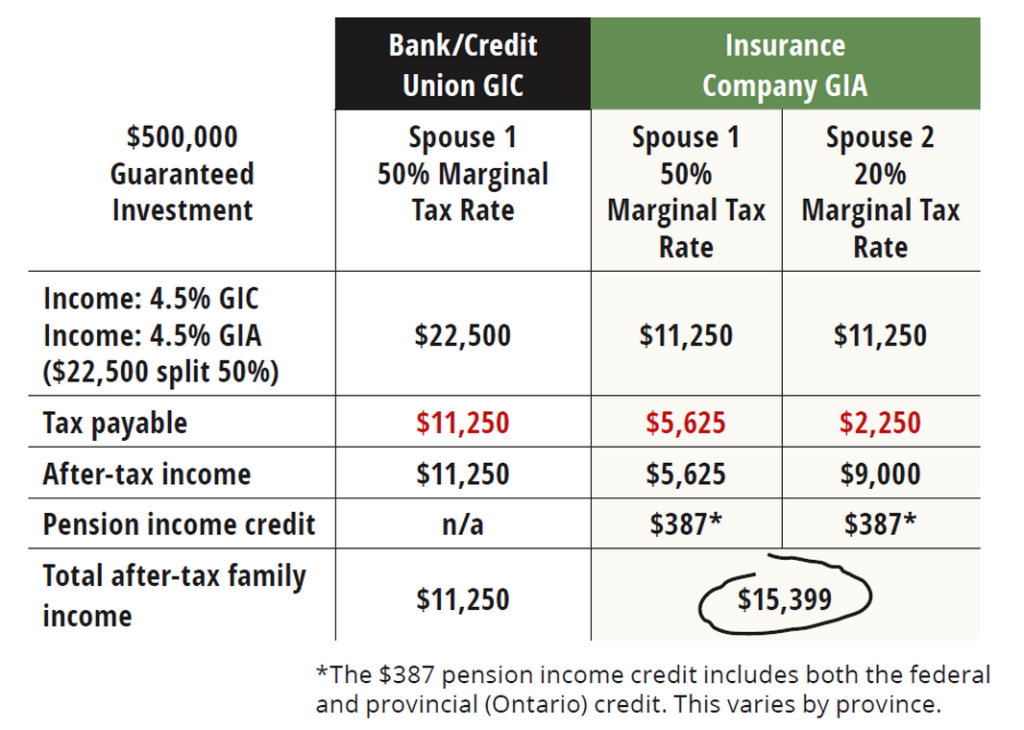

(GIA) provided by an insurance company. Unlike a Guaranteed Interest Certificate (GIC) from a bank or credit union, life insurance companies report their interest accrued as annuity income. Once reported, this qualifies for the pension income credit at age 65. As a result, you and your spouse are allowed to transfer 50% of this eligible income to the lower income spouse. This is a tool very few people know about that can save you thousands of dollars in unnecessary taxes.

Below is an example where both spouses are 65 and are at differing marginal tax rates. In this example, more than $4,000 in unnecessary taxes were saved on a single guaranteed investment. That’s enough to pay for that fly-in moose hunt. Married or not, non-registered GIAs also offer inherent estate planning advantages by legally avoiding unnecessary delays and fees associated with probate when settling your estate.

To split income with your spouse, you and your spouse must make a joint election on your tax returns using government form T1032. Working with your CPA and accredited financial professional, you can find the money. Happy hunting!

Originally published in Ontario OUT of DOORS’ 2024-2025 Hunting Annual